King William County and Dreaming Tree Farms Meals Tax Communications

In the spirit of transparency, included below are screenshots from emails and documents that are relevant to the issue at hand.

This is the treatment that I've received with all levels of King William leadership after trying to collaborate to resolve this issue in a professional manner. It is my opinion that allowing this treatment to happen and not doing anything about it is the same as supporting it.

If you haven't already read the summary overview, I encourage you to understand the issues first.

The only taxable salad, based on the Commonwealth of Virginia Food and Beverage Tax Code are: "prepackaged single-serving salads consisting primarily of an assortment of vegetables"

August 8, 2019: Sally Pearson clearly describes the Farm-To-Salad product as more than a single serving based on her own customer experience.

"My husband and I split it for dinner and we couldn't eat it all"

-Sally Pearson commenting on one of her weekly Farm-To-Salad deliveries.

So tell me again how its determined to be a "single serving"?

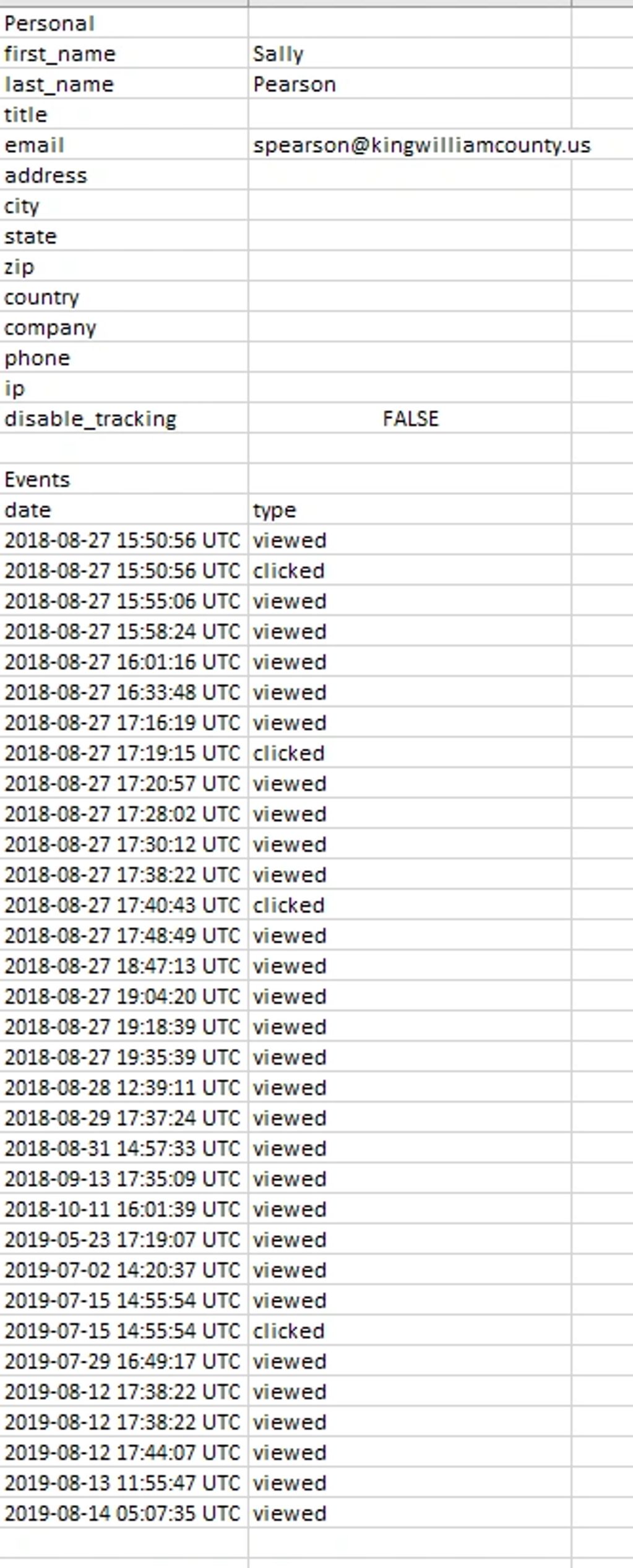

Sally Pearson interacted with emails describing the weekly salad service over 33 times in the year prior to assessing the tax.

Each week an email is sent out with a description of the salad of the week and other farm updates. Sally and others in her office asked to be put on the distribution list when I came to apply for my business license in 2017. They received every email from Day 1.

This proves she had full awareness of the product that was being sold in all of 2018 and 2019 and knew I was not collecting Meals Tax

August 7, 2019: Sally presents the Virginia Beach Guideline Document as a way to justify the King William Tax

Virginia Beach guidelines have NO relevancy to the King William Tax Code.

Sally Pearson hasn't, in the 10 years the King William Meals Tax Ordinance been in place, published a document as required by County Code. I have raised this from the very beginning and still, almost a year later no document has been published.

King William code Sec. 70-333 reads, “The commissioner of the revenue shall pro

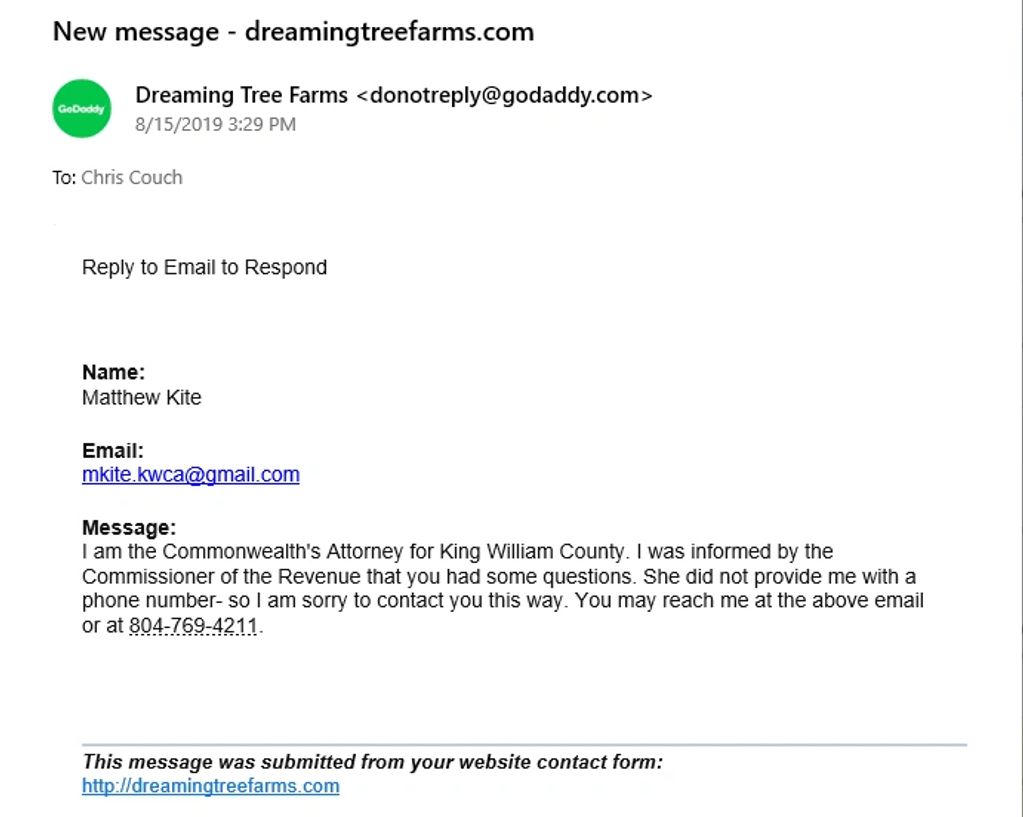

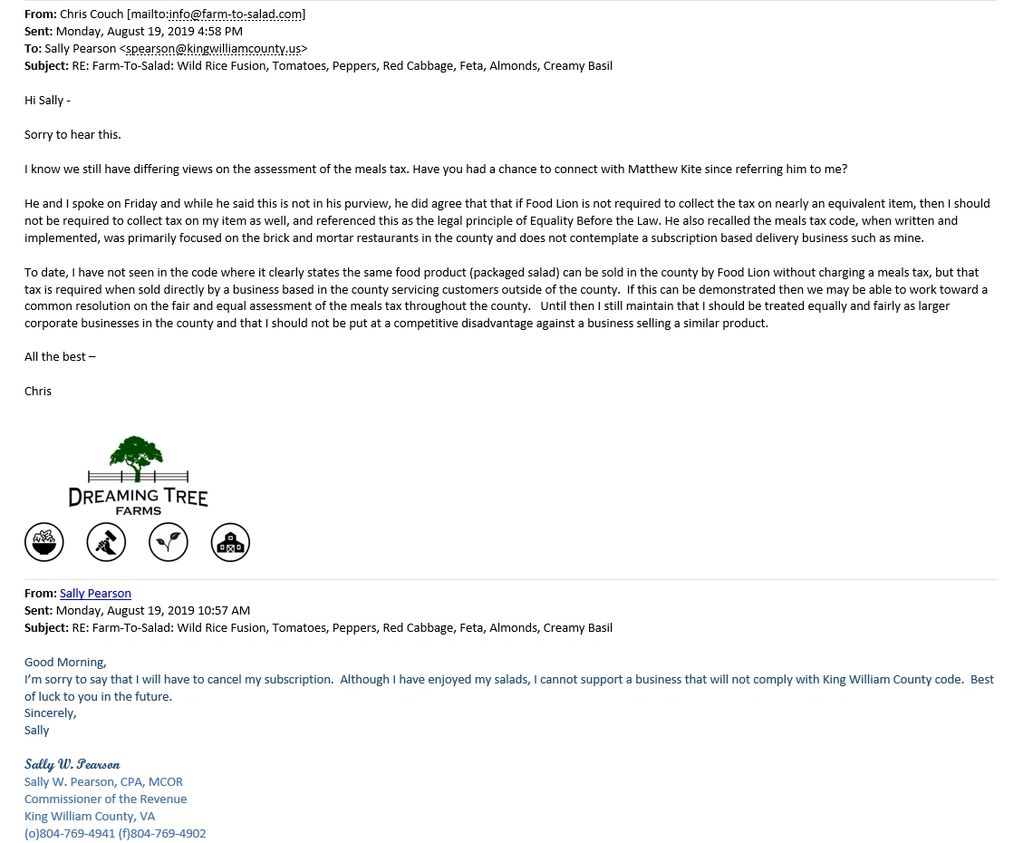

August 19, 2019: Sally Referred me to Commonwealth's Attorney then Cancels Salad Subscription

When I asked that we bring the County Attorney in to discuss this matter, she instead asked the Commonwealth's Attorney to call me - but didn't provide my contact info. I had a good conversation with Mr. Kite as documented in the email below.

Sally cancels her email, and my response.

August 26, 2019: Meet with County Administrator

Notes from the meeting

Met with County Administrator, Bobbi Tassinari to explain situation and seek advice on how to resolve. I explained that this was an open risk to by business and I didn't believe the meals tax when written ever envisioned a business such as mine. Explained that I’ve reviewed code but didn’t come to her to do a line by line code review with her, and would welcome the opportunity with the County Attorney to explain my interpretation so this could be resolved

I presented three possible solutions to the move on from this problem:

1. Continue the disagreement between the Commissioner and I may end up in litigation and all of this would become public.

- KW becomes the county going after their farmers and small business owners for taxes without justification

- People ask why now, and why haven't they been collected to date? What about back taxes? Wasn’t the Commissioner supposed to track this?

- Not a good use of anybody's time or money

2. Amend the code - focus on a positive spin

- Highlight the FDA definition of serving size to avoid any other interpretation

- Clearly make all prepared salads for off site consumption free from collecting meal tax free

- Or add an exception for supporting local farm businesses

- Promote healthy eating choices

- Consistent regardless of who is selling the product

- Tax benefit to the citizens – pay less for healthy food choices

- No impact to the county as the taxes are not being collected today!

3. Written letter from KW County saying I am not responsible for collecting meals tax (sample upon request)

- Easiest and best interest for the county and my business

- Akin to a special use permit - no one else in county is doing what I'm doing.

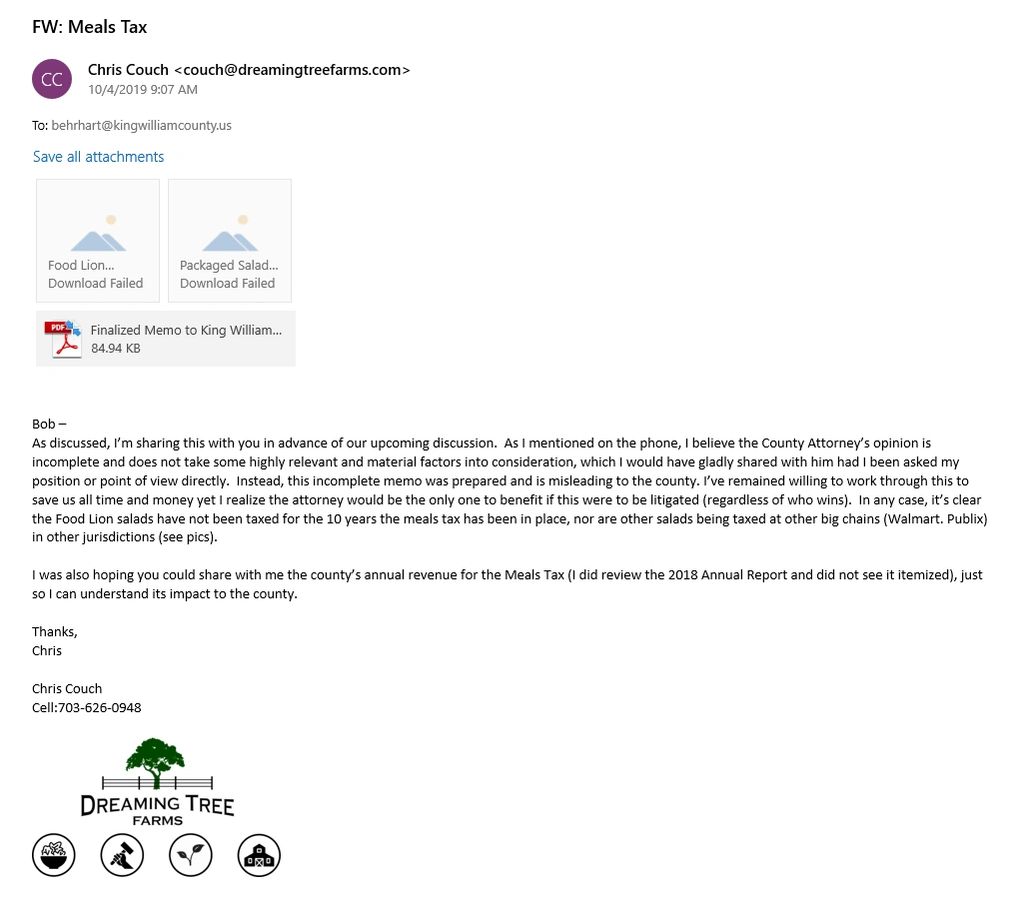

September 20 - October 4, 2019: Escalation to County Administrator County Attorney, and Board

September 20, 2019: Almost a month after bringing the issue to the County Administrator on 8/28 and requesting a sit down to review the code and the issues, I was sent a memo authored by the new County Attorney. Upon review this memo failed to address any of the relevant issues and clearly failed to represent my business model and the Farm-To-Salad product.

- No mention of the Serving Size Exem

September 23, 2019: I requested (again) to sit down and review the code since relevant sections of the code were completely absent from the County Attorney's memo.

The County Administrator outright refused this request.

You can see the Chairman of the Board of Supervisors was copied on the note. To my knowledge this was never forwarded to other Board members.

October 4, 2019: After being shut down by the County Administrator, I reached out to my Board of Supervisor Representative. You can see my efforts again to try and collaborate and save the county, and my business time and money.

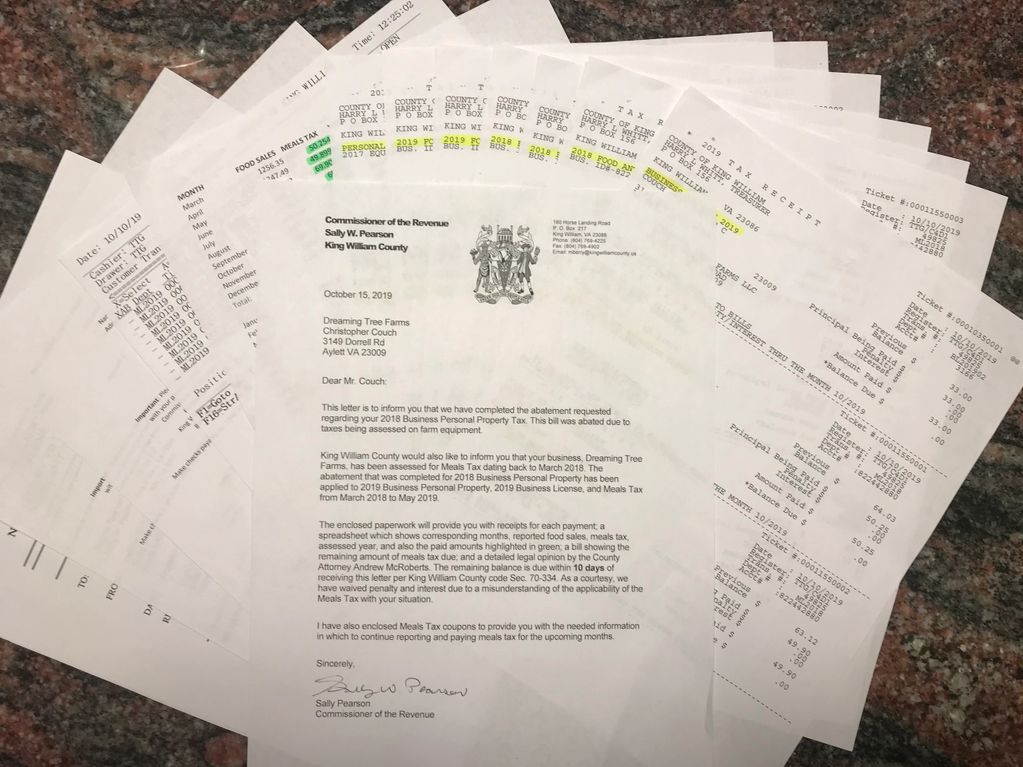

October 15, 2019: Sally Abates Erroneous Taxes from Prior Year and Assesses over $1,500 in back taxes on all food sales in all jurisdictions.

Even IF the Farm-To-Salad product was taxable under the Meals Tax Ordinance it would only be for salads sold in King William County. As of this date, the total tax due would have been less than $7.

The amount of work that went into preparing this erroneous assessment.

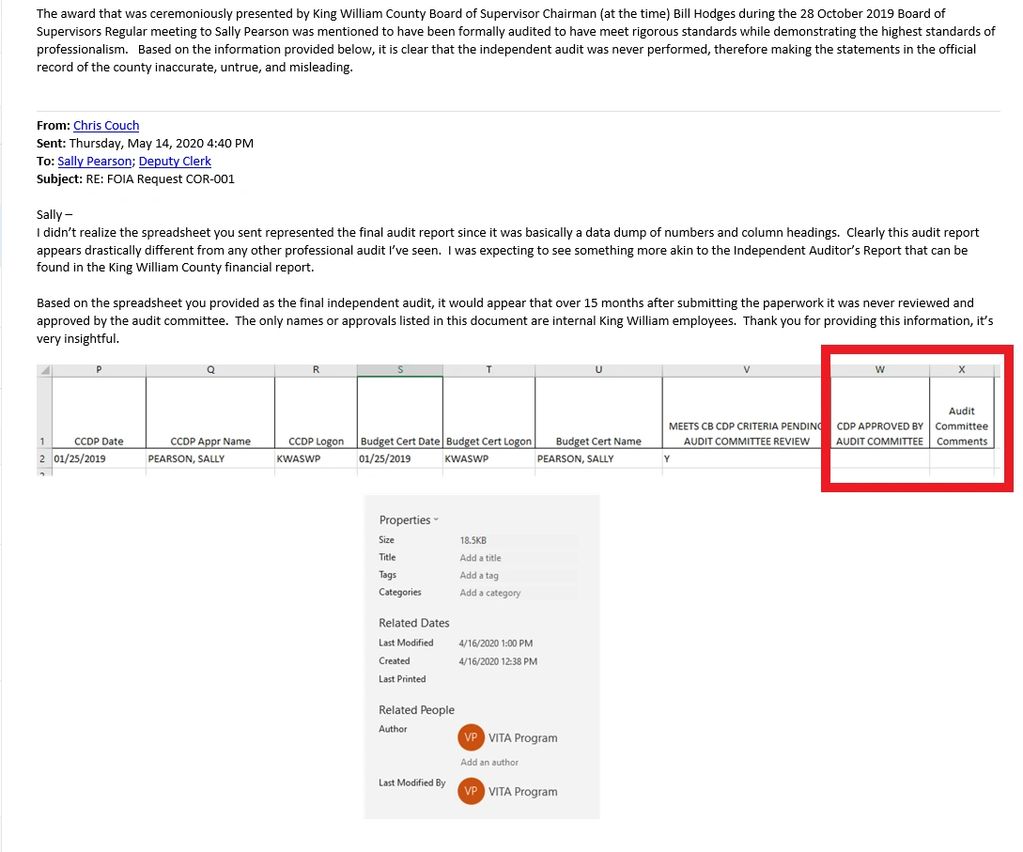

October 28, 2019: Sally Pearson Presented Accreditation Award by Board. FOIA shows the audit was never performed.

This award, from Sally, to Sally by the Association which the taxpayers pay her to be a member of, was given in an election year.

NO AUDIT PERFORMED

After submitting a FOIA for the audit documentation and audit report, what I received was a spreadsheet with column heading and numbers. There was no official audit report, and there was no copy of the documents to support the "twelve standards" that were so rigorously set forth by this Association.

FALSE, INACCURATE, MISLEADING information Supported by the Board of Supervisors, and entered into public record.

Source: Country Courier, 2019-11-13

WHERE IS THE AUDIT?

October 31, 2019: Commissioner of Revenue's office mocks Dreaming Tree Farms Farm-To-Salad at a King William Administration Halloween Party

Commissioner Sally Pearson and her staff dressed as various salad ingredients for the County Administration Halloween Party.

(Left to Right)

Deputy Commissioner Pauline Miller dressed as a tomato.

Commissioner of the Revenue Sally Pearson in a shirt with a head of lettuce and the words ‘romaine calm.’

Deputy Commissioner Barbara Ford dressed as a red onion.

Deputy Commissioner Miranda Berry dressed a

Apology submitted into public record for mocking a local farm and small business in the county she was elected to serve.

Bad press for King William County. Read the full article here.

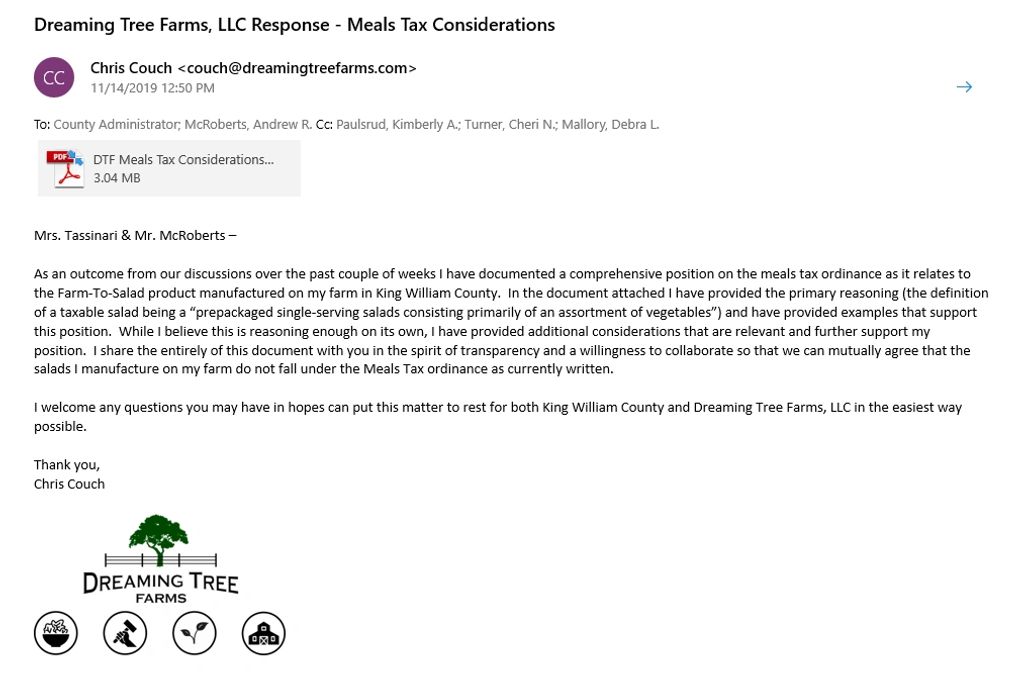

November 14, 2019: Provide detailed justification why the Meals Tax is not applicable to the Farm-To-Salad product

Trying once again to collaborate with the County.

This is the cover page to a more comprehensive document (21 pages). To my knowledge this document was never shared with the Board of Supervisors, and based on follow up questions and statements by the County Attorney it would appear as it was never read or taken seriously.

This document was later included as part of my Administrative Appeal, and NONE of the relevant facts on Serving Size or the s

A Summary of the timeline of events at the time. Provides some additional detail when setting up the business and the guidance I was provided.

Also note the multiple justifications I was provided, each entirely false!

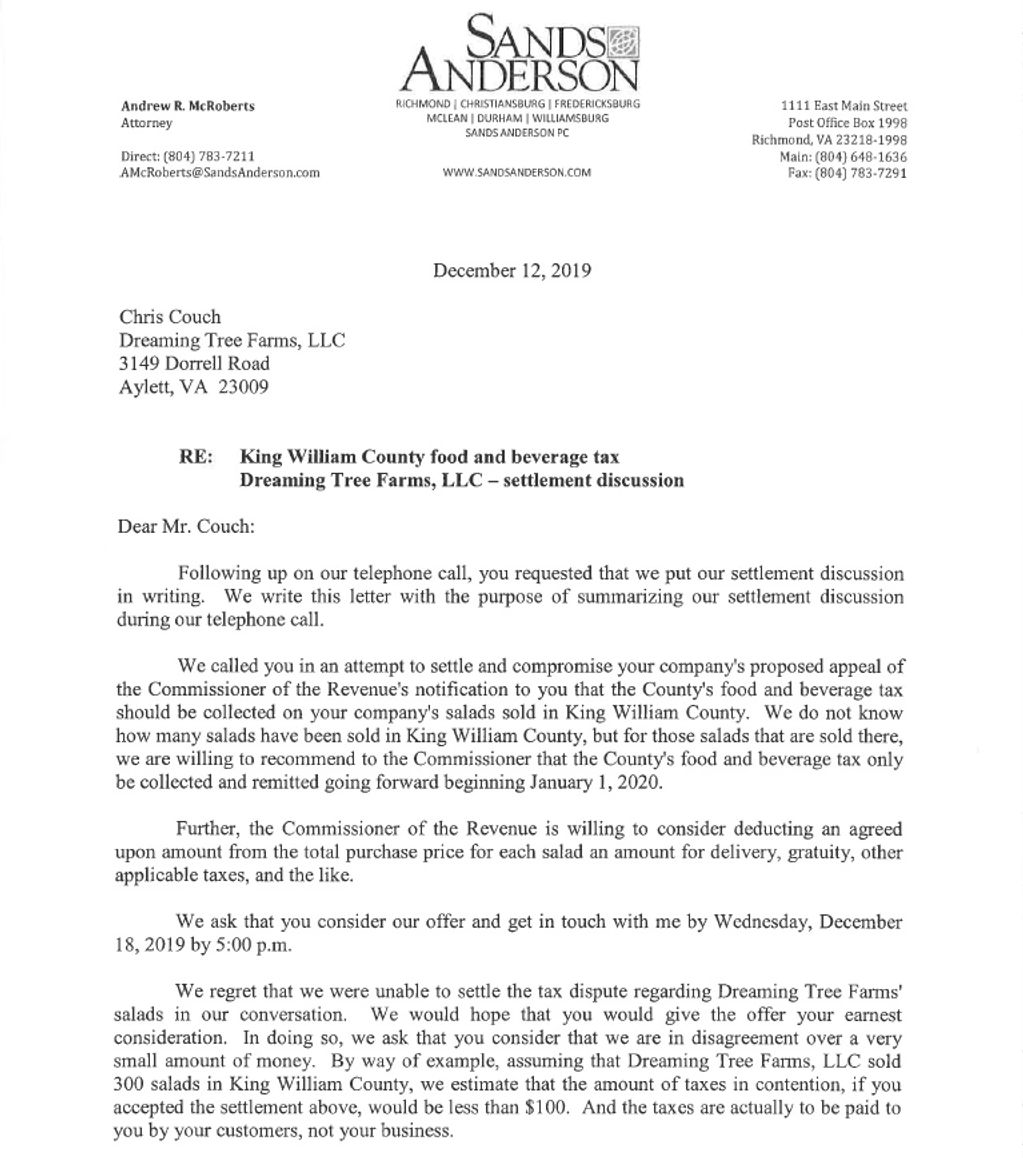

December 12, 2019: County Attorney response to my 21 page document

Note:

- No rebuttal to the facts presented in my document about the FDA's definition of serving size

- Indicates they "do not know how many salads have been sold in King William County". This number (less than 20 at the time) was on Page 2 of my document.

- Offers to "deduct an agreed upon amount from the total purchase price". This is in violation of the King William County Meals Tax Ordinance, makin

- Attempts to convince me to accept the tax not with justification of fact but in saying "the cost of an attorney would likely cost many times the actual amount of taxes"

January 13, 2020: Email to New Board of Supervisor

With a new Board member representing my district, I send an email and include the consideration document I sent the county in November. Hoping once again to work through this, yet indicating I would not concede to insulting or illegal settlement offers made by the county.

February 14, 2020: Letter sent to All of the Board of Supervisors

Going nowhere with the County Adminsitrator and County Attorney I try to include all of the Board of Supervisors once again to try and resolve this matter.

NOTE: Not a single response from any one of the board members to this email.

My district representative (s) have been responsive and attentive to me through this time but as is often highlighted, one Board member alone has little power.

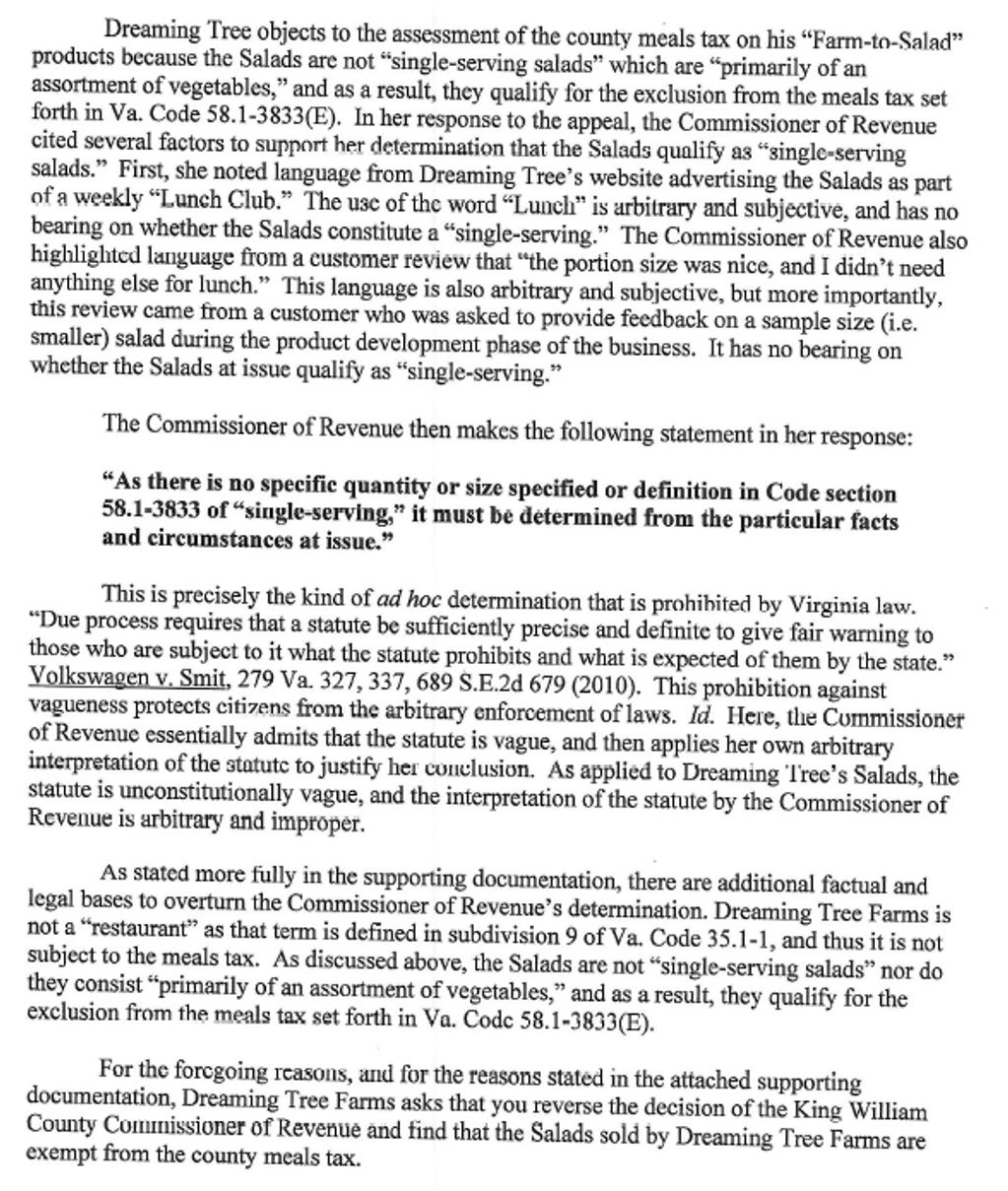

April 29, 2020: DTF Appeal to the State Tax Commissioner

As the Commissioner of Revenue failed to provide any justification other than "her opinion" in her response to my administrative appeal, the assessment was appealed to the Virginia State Tax Commissioner.

“Due process required that a statue be sufficiently precise and definite to give fair warning to those who are subject to it what the statute prohibits and what is expected of them by the state” Volkswagen v. Smit, VA 327, 337, 689 S.E.2d 679 (2010)

This prohibition against vagueness protects citizens from the arbitrary enforcement of laws.

Summary Rebuttal Referenced in the Appeal to the State Tax Commissioner

May 7, 2020: Email sent to BoS Representative

Provide update and highlight there are multiple instances where King William is in violation of State and County Code (law).

May 12, 2020: King William Request the State Tax Commissioner to Dismiss the Appeal

The King William County Attorney's office originally suggested that we follow the appeal process and not proceed to court. Only to request dismissal once I did follow the administrative appeal saying the state doesn't have jurisdiction in this matter.

Why would King William County not want the State Tax Commissioner to provide clarification when it's the State Tax Code that exempts my product?

If the appeal is dismissed by the State Tax Commissioner, it would force this matter to circuit court at additional expense to my farm and to the county.

May, 2020: Emails sent to BoS Representative

May 14, 2020: Notifying the BoS that King William County Attorney sent a letter to the State Tax Commissioner asking him to dismiss my appeal, which would force this issue to court. This was done without the knowledge of the Board of Supervisors.

Since the County Attorney and County Administrator report to the Board, any action on their part represents an action on the Boards part.

March 15, 2020: Another update.