Context for the Meals Tax Issue

A Tax on the Customer, not the Business, But a Tax that's not Justified.

When I established this farm based business in late 2017 I reviewed the business model and the Farm-To-Salad product with the King William County Commissioner of Revenue's office. After a lengthy review I was not directed to collect a meals tax on this product, due in part to the fact that this business is not a restaurant or food truck serving custom meals and manufacturing businesses are clearly exempt from the Food and Beverage Tax.

After my business was up and running for 18+ months, the Commissioner then decided the Farm-To-Salad product should be charged an additional Meals Tax. I disagreed and asked for evidence to support this change in position. Based upon my review of the Food and Beverage tax law, as well as other lawyers and associations that have reviewed my case, we do not believe it is a valid tax on the Farm-To-Salad product. I was not given justification and when I told Mrs. Pearson I didn't think the Meals Tax was applicable to the Farm-To-Salad product I was told frankly in the lobby of her office that it didn't matter what I thought, that she was the Commissioner and she gets to make the determination. That didn't sit well with me.

The meals tax in question is not a tax that is charged to a business, it is one that is charged to the end customer, just like a retail or food tax. Since starting my business I have been collecting and submitting the food tax on every product I sell. I do not question the validity of the food tax.

It would be simple to just charge my customers this additional meals tax, and King William County has used this reasoning to try and resolve the matter. Rather than just roll over and accept their argument without any evidence, I am standing up in defense of my customers.

Sally Pearson, the King William County Commissioner of Revenue has provided multiple justifications for the tax and each time I was able to dismiss them with little effort. If it can be shown to me how my product, and the structure of my business, qualifies for the tax then I will comply.

This is a complex matter, and one that cannot be glossed over with assumptions. I will stand my ground in defense of my customers and what I feel is right.

We are not a Restaurant, and our Salads are not Single Servings

How does King William treat small farm & business owners?

By Harassing and Mocking Their Business

Resulting in a public response from the County Administrator

Resulting in a public response from the County Administrator

As the issue and the criticism of the unjust ruling became public, the staff of the King William County Commissioner of Revenue's office thought it was appropriate to mock this county farm and dressed as a Salad at the 2019 County Administration Halloween Office Party.

Resulting in a public response from the County Administrator

Resulting in a public response from the County Administrator

Resulting in a public response from the County Administrator

Read the story from the Tidewater Review press here :

The Definition of a Taxable Salad

In order to be taxable, a salad must meet the following definition as set forth in the State Code of Virginia § 58.1-3833 and is also provided in the King William Code of Ordinances Sec. 70-325.

"prepackaged single-serving salads consisting primarily of an assortment of vegetables"

The first part of this definition describes this product as a "single-serving". Serving size is clearly established by federal dietary guidelines (FDA) and is not the same as an amount one chooses to eat at one time. These differences are described in this article.

"Serving size is a standardized amount of food. It may be used to quantify recommended amounts, as is the case with the MyPlate food groups, or represent quantities that people typically consume on a Nutrition Facts label. Portion size is the amount of a food you choose to eat — which may be more or less than a serving."

The salads I prepare typically weigh 15-17 ounces and most of my customers get multiple portions from the salad I deliver to them once a week. Do some eat them in a single sitting? Sure they do! However that does not make them a "single serving".

For example, a single serving of raw leafy greens is the equivalent of 1 cup. (reference) These salads typically have 4 cups of greens in addition to all of the other ingredients.

I even received an email from the King William Commissioner of Revenue on Aug 8, 2019 that said, “My salad last night was delicious! My husband and I split it for dinner and we couldn’t eat it all Wish I could eat that clean every day.”

The second part of the description also exempts my product from the definition. These salads always contain ingredients that are not "vegetables". Including but not limited to, farm-made dressings, grains, seeds, nuts, cheese, and in some cases fruits or an egg.

By net weight, these salads do not consist "primarily of an assortment of vegetables".

King William says Serving Size is not defined, yet we teach this term in grade school!

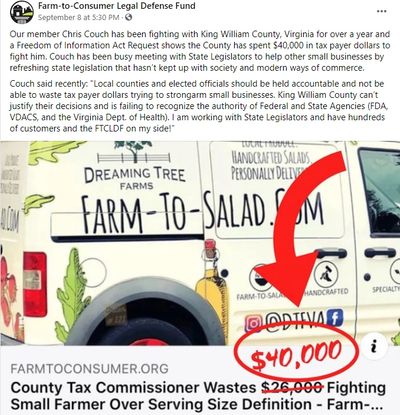

Farm-To-Consumer Legal Defense Fund Support

County Tax Commissioner Wastes $26,000 Fighting Small Farmer Over Serving Size Definition

Couch is a Farm-to-Consumer Legal Defense Fund (FTCLDF) member and FTCLDF attorney Suzy Israel is advising Couch and his attorney on this matter. “This is an egregious example of a farmer being abused at the hands of a bureaucratic despot, who long ago dropped any pretense of fairness,” Israel stated. “I have battled dozens of local government officials during my work with FTCLDF, but King William County’s mean-spiritedness is stunning in its brazenness. Although the County’s blatant disrespect is unusual, this win-at-all-costs mentality is not uncommon among local governments. And it is exactly why so many enterprising small farmers cannot get their businesses off the ground.”

UPDATE: The total King William has spent on legal fees for this issue is over $50,000!

Richmond Times Dispatch July 24, 2020

There’s been a yearlong food fight in King William County over less than a $100 meals tax bill

Visit by House of Representative Delegate Scott Wyatt

I had the opportunity to welcome Virginia Delegate Scott Wyatt and his Legislative Director to the farm. We discussed market farming, sustainable agriculture, and challenges small business owners face that can be easily addressed through legislative changes. It was refreshing to see elected officials take interest and support the issues their constituents face.

After a quick tour we sat down and discussed the history and the same materials I've shared with King William County. It didn't take long to agree the Farm-To-Salad product is not a single serving, and the State Food Safety experts that regulate the entire state define my business as a Food Manufacturer and not as a Restaurant.

Farm to Consumer Legal Defense Fund Update

Our member Chris Couch has been fighting with King William County, Virginia for over a year and a Freedom of Information Act Request shows the County has spent $40,000 in tax payer dollars to fight him. Couch has been busy meeting with State Legislators to help other small businesses by refreshing state legislation that hasn’t kept up with society and modern ways of commerce.

Couch said recently: "Local counties and elected officials should be held accountable and not be able to waste tax payer dollars trying to strongarm small businesses. King William County can’t justify their decisions and is failing to recognize the authority of Federal and State Agencies (FDA, VDACS, and the Virginia Dept. of Health). I am working with State Legislators and have hundreds of customers and the FTCLDF on my side!”

King Williams Constitutional Officer Shortfalls

King William County Commissioner of the Revenue refuses to cooperate with audit, emails show

King William County Treasurer’s Office under internal investigation; improper tax collection, poor b

King William Commissioner of Revenue’s Office audited, loses staffer amid property reassessment

Pearson’s refusal to participate in the audit comes nearly six weeks after she declined to take part in the county’s reassessment process, one of the essential functions of her office.

King William Commissioner of Revenue’s Office audited, loses staffer amid property reassessment

King William County Treasurer’s Office under internal investigation; improper tax collection, poor b

King William Commissioner of Revenue’s Office audited, loses staffer amid property reassessment

Without Commissioner of Revenue Sally Pearson’s involvement, the reassessment revealed that nearly 500 properties weren’t being taxed, some for as long as a decade. The reassessment is expected to increase the county’s tax revenue by more than 25%, a significant increase needed to fund other departments.

King William County Treasurer’s Office under internal investigation; improper tax collection, poor b

King William County Treasurer’s Office under internal investigation; improper tax collection, poor b

King William County Treasurer’s Office under internal investigation; improper tax collection, poor b

A King William County financial inquiry into the treasurer’s office found nearly $2 million of uncollected real estate taxes, numerous bank accounts at multiple banks, and treasury employees handling taxpayer dollars without supervision.

Slides Shared with the Board of Supervisors 9-28-20

Whats Next?

Using King William's logic, they can interpret the definition of "Acre", "Pound", "Square Foot", or "Day" to their liking since those terms are not defined in the Tax Code either.

I am in disbelief that this definition of Serving Size be so cavalierly undermined and misconstrued in King William County, seemingly in order to advance a personal vendetta, and to the detriment of common treatment by the law.

If you'd really like to understand the treatment this small business has received over the past year, follow the link below for the detailed timeline. DTF is not alone as other small businesses describe similar dishonest, manipulative, and harassing treatment.